Intro

NGL HonestLTC, released in early 2026, is the updated version of NGL EssentialLTC.

Like those old Avis ads, “We’re #2. We try harder,” NGL doesn’t get the same mindshare as hybrid policies, but it keeps refining its traditional coverage to better serve policyholders.

This individual or joint traditional policy that stands out in the world of long-term care insurance (LTCi) for a few optional features:

- Strong benefits: Get the most for your premium

- Joint policy: Lower costs for two people under one plan.

- More tax savings: Lower your overall policy costs.

As you consider your options, let "LTC" guide you: Learn about options, Talk with family, and Create a plan that supports your shared future. If you want to insure for the costs of Alzheimer's care, this policy should be considered in your plan.

Post jargon

benefit: the amount LTCi pays for covered care expenses

benefit period: the maximum time LTCi pays for care after criteria are met

benefit pool: total amount available in LTCi for care expenses

cash indemnity: pays the full benefit, regardless of the actual care costs

death benefit: a payout to a beneficiary from a hybrid policy after the insured passes away

elimination period: the waiting period after criteria are met before benefits start

exclusion: an insurance rule that denies benefits for specific risks

inflation protection: LTCi benefit that adjusts for rising costs

premium: the payment to maintain insurance

rider: an insurance add-on

underwriting: insurer’s review process to decide coverage and cost

➡️ Explore all the LTC jargon

Standard benefits

HonestLTC also comes with many standard benefits of modern LTCi policies:

- Guaranteed benefits: Your payouts always match your policy terms.

- Benefit triggers: Coverage starts when you need help with two ADLs or cognitive decline.

- Broad coverage: Includes home health care, adult day care, assisted living, nursing homes, memory care, CCRCs, care coordination, respite care, and hospice.

- Inflation protection (optional): Keeps your benefits aligned with rising costs.

What's special about HonestLTC?

In a competitive market, policies often include standout features to set themselves apart. Let’s take a closer look at what makes HonestLTC special.

Strong benefits

HonestLTC offers some of the strongest benefits among traditional policies and, depending on your goals, can be even more compelling than many hybrid options.

Joint policy

HonestLTC offers two options: an individual policy and a unique joint policy—the only traditional joint policy on the market.

The joint policy differs from buying two individual policies in a few ways:

- Lower overall cost: Joint policies generally cost less than purchasing two separate policies.

- Shared benefit amount rider: For an extra cost, partners can access an additional pool of benefits—providing extended coverage without paying for the lifetime benefit option.

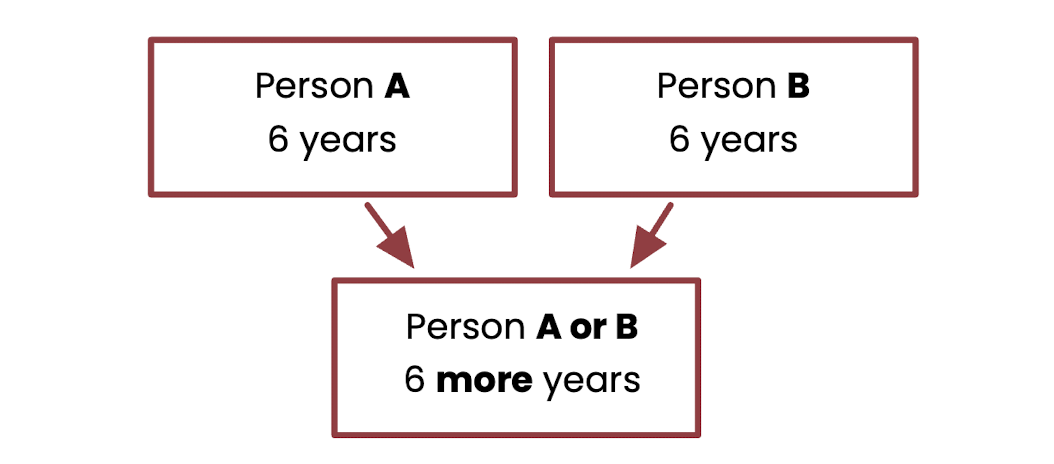

Here's how it works:

- Each partner starts with a fixed benefit period. In this example, we'll use 6 years.

- If Partner A or B uses their 6 years, they can tap into a third, shared pool of an extra 6 years.

In the above example, person A could use 6 years of benefits and person B could use 12 years. This option can help to pay for extended memory care costs.

More tax savings

As a traditional policy, HonestLTC offers greater tax deduction opportunities. It also qualifies as a partnership policy, which can help protect some of your assets from MedicAID spend-down requirements if you deplete your LTCi benefits.

The details

If this policy sounds intriguing, we'll go for a drive to share what you need to know.

We rate each policy’s benefits, premiums, underwriting, and company on a three-star scale, with three stars being the best.

Benefits

Benefits are what the policy pays for covered care expenses.

HonestLTC offers some of the highest benefits when you need care on the market.

Premium

Premiums are the payments made to maintain insurance coverage.

This policy provides a cost-effective option to cover two people with a joint policy.

Underwriting

Underwriting is how an insurance company evaluates your health and history to determine coverage and pricing.

NGL offers fairly standard underwriting. See the top of this post for current state availability.

Company

Choose a top-rated insurer for reliable LTC coverage. We work only with financially strong companies to ensure they’ll be there when it counts.

NGL is a well-established company with a strong rating, but we offer a few insurers with higher ratings.

Comparisons

How does HonestLTC compare with other LTCi policies? Focus on what matters most to you to make the best policy choice.

Benefits

In this table, you can compare the benefits of all the LTCi policies we offer. You can:

- Search for any detail.

- Tap any column title to sort.

- Scroll right to view more columns. ➡️

Next steps

If this policy seems like a good fit, click the link below and include 'HonestLTC' in the notes section at the final step.

Wrap up

Like Avis, this is an insurer that’s trying hard to earn your business. With strong benefits and an optional joint policy with shared benefits, it’s worth getting a quote.