📺 Watch this and other posts on YouTube or listen on Spotify, Apple Podcasts, and YouTube Music.

Intro

I'd like to share how my wife and I decided to buy our own long-term care insurance policy. Since I’m someone who nerds out on this stuff, and sells a lot of these policies, I thought sharing our process could be helpful to you.

About us

I'm 50 and Nicole "isn't 50 yet." We’re both in pretty good health, we’ve got two kids, and live in Colorado. We’ll be paying for our insurance through my company, which affected our choice.

Why buy?

For us, it came down to what we want for our kids and for each other.

We didn’t want the kids to worry or carry the physical or financial burden of our care when we get older, so this plan takes that weight off their shoulders and ours.

Our anchors

To start, we discussed our anchors. When I meet with clients, I ask about anchors, or the things that matter most.

How long do you want coverage?

We’ve always looked at insurance as protection against the really big, expensive events. So for us, it made sense to go with longer coverage.

If you don't need care, would like to get money back to your kids?

We liked the idea of refunds for our kids, but it wasn’t our top priority. Honestly, just owning the insurance felt like a gift in itself.

Would you like cash payouts or reimbursement?

We preferred cash payouts for the flexibility. We’ve had some bad experiences getting things like health insurance claims covered.

Our priorities, listed top to bottom, were:

- Long benefits

- Good tax breaks

- Flexible cash payouts

- Refund to our kids if we never needed care

Short list

We narrowed our list down to three policies:

- Nationwide CareMatters with seven years of benefits

- Securian SecureCare with eight years

- OneAmerica Asset Care with lifetime benefits

Each of these also includes a refund and at least some cash benefits.

Tax benefits

Uncle Sam actually offers quite a few tax incentives for buying long-term care insurance. In our case, we’d be paying for the insurance through my company.

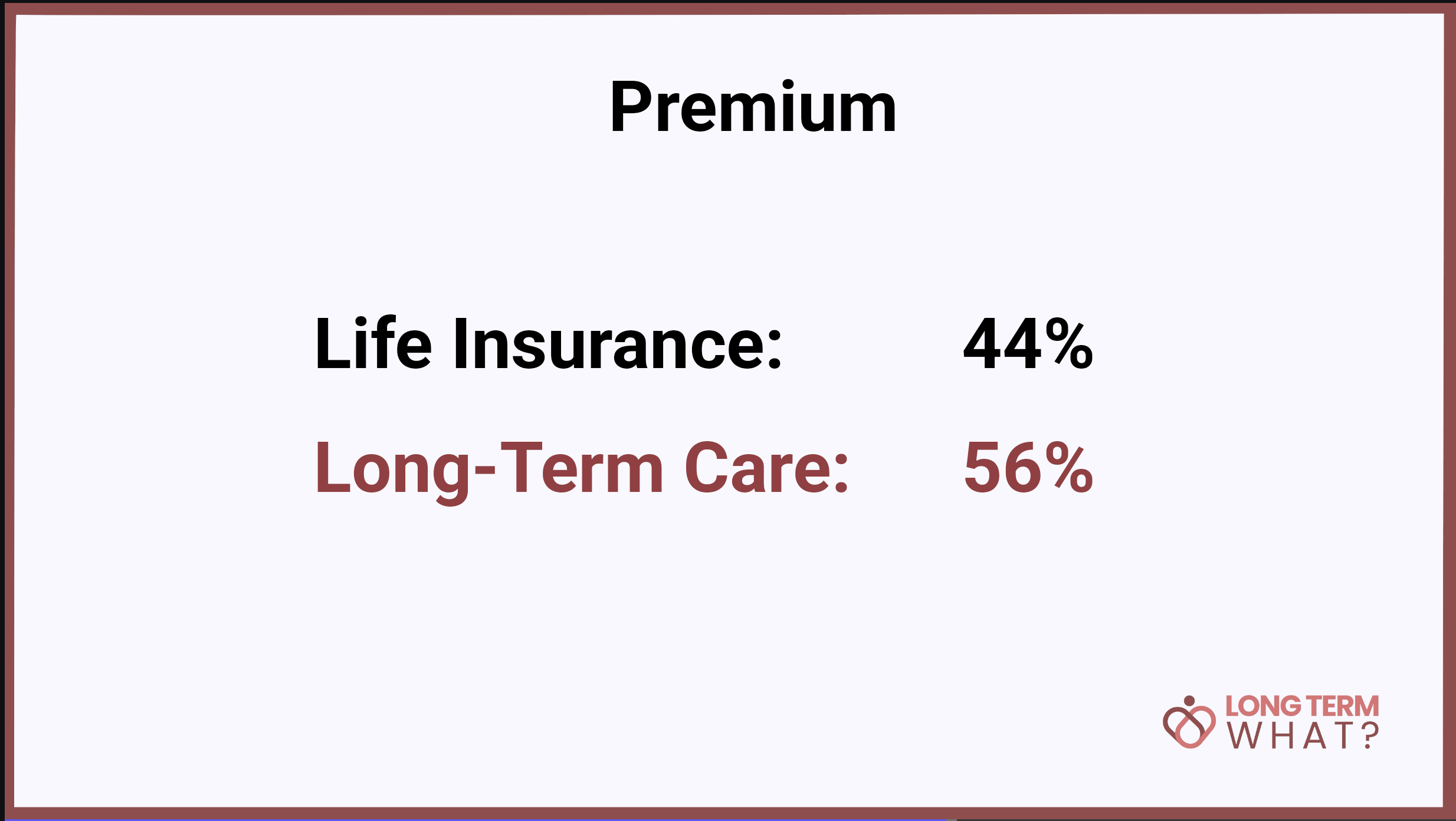

All the policies on our short list split the premiums between life insurance and long-term care insurance, which helps unlock those tax breaks.

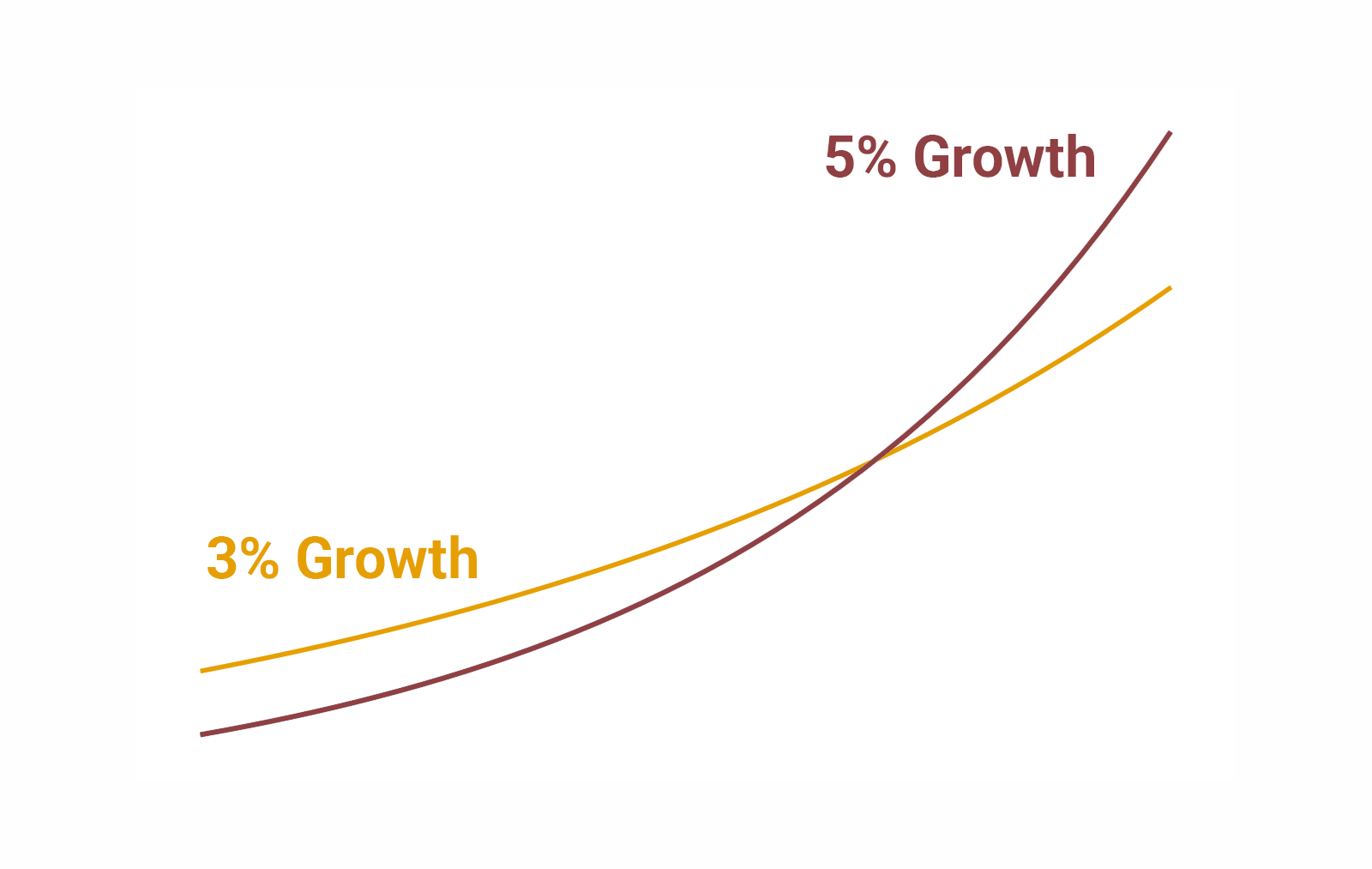

Related, in long-term care insurance, your benefits can grow every year to help keep up with rising care costs. I compared 3% benefit growth versus 5%.

With 5%, more of the premium goes to the long-term care side of the policy, which is better for tax breaks.

For our specific situation, the 5% growth option really pulls ahead once we’re in our late 70s—and that’s usually the time when care is needed the most.

Health pre-screen

Once we had our top three, we did a health pre-screen.

Pre-qualifying for insurance is a really important step. We filled out a health form and shared it anonymously with our top three insurers to get their feedback before officially applying.

One insurer asked us to wait a few months before applying because of some recent physical therapy Nicole was doing on her shoulder. The others gave us the green light to move forward now. So we weighed our options with the window of good health we were in that moment.

Then we decided on a winner...

The winner 🏆

We chose a joint policy with OneAmerica’s Asset Care.

It didn’t check every single box, but it stood out as the best fit for us because of its lifetime benefits.

Are lifetime benefits over-insuring? It’s not the right fit for everyone, but for us, it felt worth it. Here's one reason why.

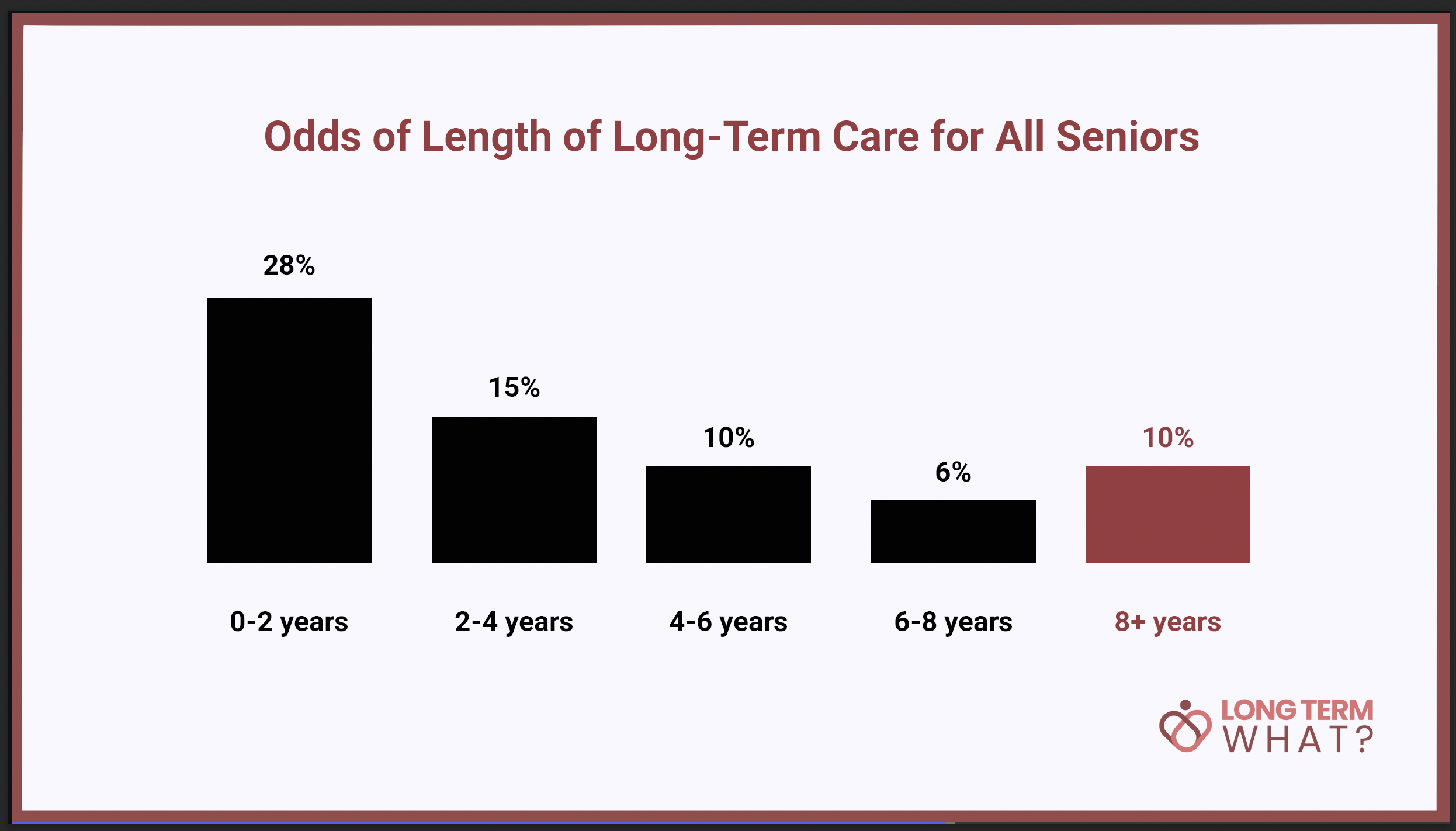

A large, well-known study found that for adults who make it to age 65, about ten percent will need more than eight years of care—most often because of cognitive decline, like Alzheimer’s.

Ten percent. And when you think about the odds of either of us needing more than eight years, those odds roughly double.

That’s why lifetime coverage gives us peace of mind. 👍🏻

Applying

We started the application process.

Our pre-qualification showed we should be approved, but it wasn’t a guarantee.

We each did a short 30-minute phone interview, and then they requested our medical records, and we had to do a quick blood draw.

A few weeks later, we got the good news: Approved.

Wrap up

I feel good knowing my kids, and Nicole, won’t have to lift me out of a bathtub when I’m 80.

And just as important, we don’t have this big unknown cost hanging over our heads as we plan and budget for retirement.

OneAmerica Asset Care may or may not be the right fit for you. That’s where we come in—our whole business is helping people figure out long-term care insurance. We work with all the top companies, so we can help you find the policy that actually fits your needs.