📺 Watch this and other posts on YouTube or listen on Spotify, Apple Podcasts, and YouTube Music.

Intro

When it comes to long-term care (LTC) insurance, it’s a two-way race: traditional policies and hybrids.

Remember those Saturday morning cartoons where the coyote tries to catch the road runner in a world ruled by cartoon physics?

Today I’m comparing traditional LTC policies to Wile E. Coyote—constantly chasing after hybrid policies, the road runner of long-term care.

It’s not a perfect analogy, but it’s largely true, and makes an otherwise dry topic unboring. 😀

Remember to use the letters LTC as a guide to achieve these goals: Learn about options, Talk with family, and Create a plan. Choosing between traditional and hybrid LTCi is an important step in reaching these goals.

Post jargon

ADLs (activities of daily living): basic tasks like bathing, dressing, eating, transferring, toileting, and continence

benefit: the amount LTCi pays for covered care expenses

death benefit: a payout to a beneficiary from a hybrid policy after the insured passes away

exclusion: an insurance rule that denies benefits for specific risks

LTC: long-term care

LTCi: long-term care insurance

partnership policy: a special LTCi policy to keep assets from MedicAID

premium: the payment to maintain insurance

➡️ Explore all the LTC jargon

The basics

Traditional

Traditional policies started in the 1960s. They’re pretty straightforward: you pay premiums, and you get benefits when you need care.

Hybrids

Hybrids came along in the late 80s. They combine LTC coverage with life insurance—that’s why they’re called hybrids.

Now let's dig into the details and why you should care.

Cash value

Think about cash value in terms of finding a place to live. You can either rent or buy.

- Renting is like a traditional policy—you pay, but when you move out, you’ve got nothing to show for it. You pay in, and if something happens, you get benefits. But if you don’t use it, you have no cash value.

- Buying, on the other hand, is like a hybrid—you get equity, or cash value. They have cash value—even if you never need care.

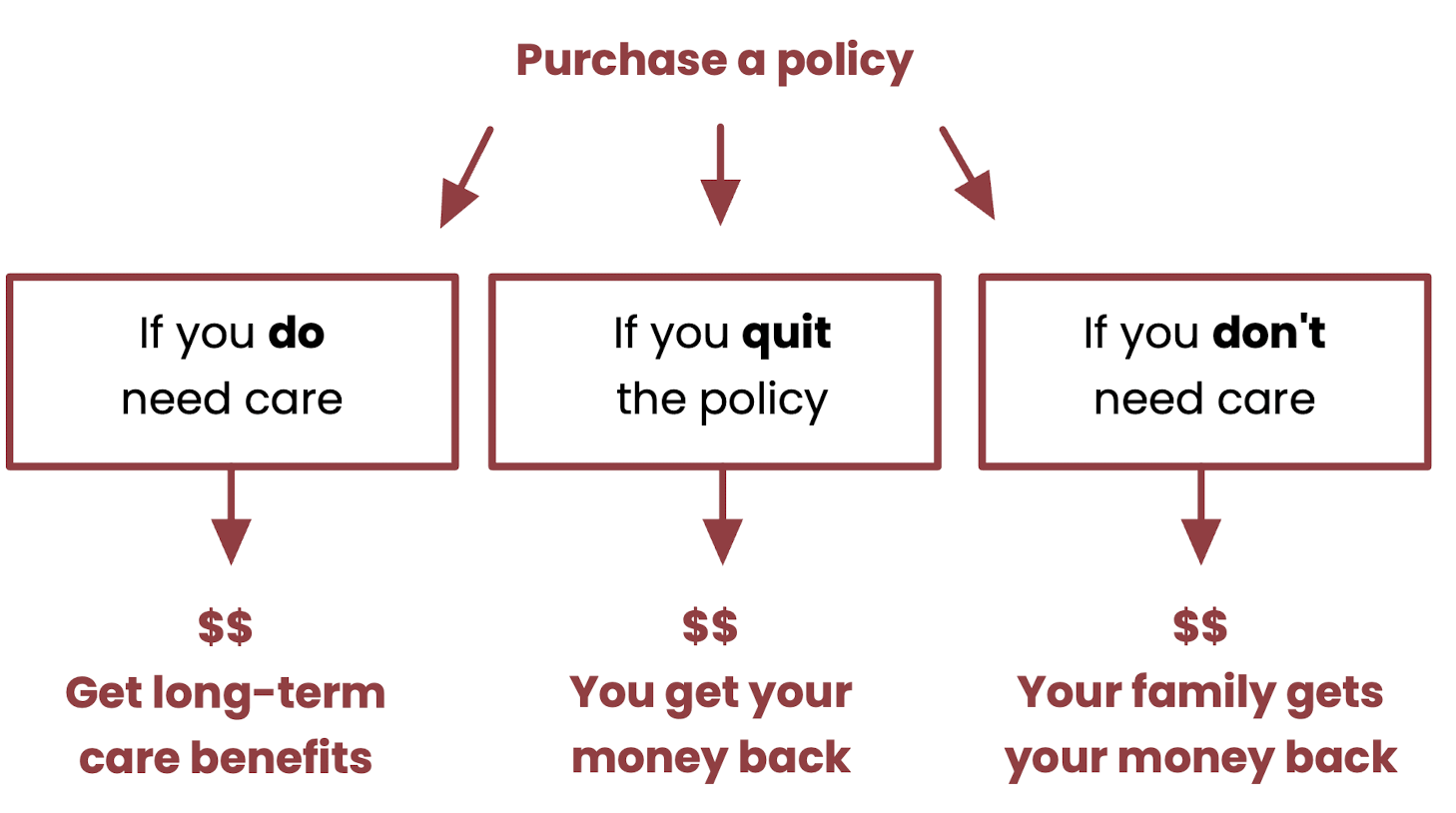

Hybrids have a popular design that provide benefits in three scenarios.

Either way, someone's getting a check. 👍🏻

Hybrids beat traditional policies here.

Refunds

Which leads us into the benefit of refunds.

- With a traditional policy, if you don’t use your benefits, the money you spent on premiums is typically lost, like most insurance.

- Hybrids, on the other hand, are different. If you don’t use your benefits, the premiums you paid are returned to your spouse or kids.

Wait… so hybrid insurance is...

Well, sort of, but it’s a bit more nuanced.

Yes, your family can get your premiums back when it's needed most, but you lose the chance to earn interest if you had invested it elsewhere.

Still, not bad. And another win for hybrids.

Benefits

Traditional policies reimburse you for long-term care expenses—like most insurance you know. You or your care provider submit receipts to get paid back.

Hybrids work differently. For most of them, you get a check—no receipts required. You can use the money however you want with no oversight—even to pay family members to provide your care.

Hybrids with this cash indemnity give you a lot more flexibility.

Premiums

With many traditional policies, you pay for life, but the insurer can raise your premium later if they underpriced it, as they've done in older policies.

Hybrids, on the other hand, come with a guarantee: your premiums will never go up.

Again, another hybrid win.

Costs

I’ve made a strong case for hybrids so far—but traditional policies can often be less expensive. Yep, the underdog makes his move.

With that said, comparing these two purely on cost can be tricky—it’s like comparing a camera to a smartphone.

Both take pictures, but one does a lot more.

You might see savings with traditional policies in three ways:

- lower premiums,

- greater tax advantages,

- and they usually qualify as Partnership Policies.

Partnership policies

Partnership policies are a special arrangement between states and private LTC insurance companies to help protect your savings if you need long-term care.

Here’s how it works. Normally, if you don’t have insurance—or if your care costs are higher than what your insurance will cover—you might need to turn to MedicAID. But to qualify for MedicAID, you’d have to “spend down” your savings—using up almost everything you have—before receiving help.

With a partnership policy, the rules are different. Every dollar your policy pays for care lets you keep a dollar of your savings. You don’t have to spend that money to qualify for MedicAID. For example, if your policy pays out $100,000 in benefits, you can still keep $100,000 in your bank account and qualify for MedicAID when your insurance runs out. This is allowed because of the special deal behind the partnership program.

Why does this matter? It means you can protect more of your savings to leave to your family when you pass away, instead of using it all for care costs.

Even if you move to another state, most will still honor this arrangement.

Wrap up

So what's the best choice for you?

If you want money back if you never need care, flexible benefits, and guaranteed premiums, a hybrid policy might be the right fit—from an insurer like Nationwide, OneAmerica, or Securian.

If you’re looking for simple, no-frills long-term care coverage at the lowest cost, a traditional policy might be your best bet—from a company like Mutual of Omaha, Thrivent, or NGL.