Long-Term Care Support for Financial Advisors

LTC Specialist • Health Pre-Screens • Educational Content

Refer A Client→

Hi, I'm Jesse.

I’m an independent long-term care (LTC) insurance specialist partnering with fee-only, fee-based, and independent advisors nationwide to support client planning. I provide value through health pre-screens, access to a wide range of policies, and clear, expert guidance—without any sales pressure.

Anonymous Pre-Screens

I offer health pre-screens. Your client completes a short health intake that I send to a few select insurers with no name attached. Insurers reply privately with a green light, red light, or “let’s wait”, giving underwriting guidance before any formal application. This process prevents a formal decline from being logged in the Medical Information Bureau (MIB), which can make future approvals by other insurers much harder.

Policies From Top Insurers

I compare all the top LTC policies and give candid opinions that balance value, benefits, and client goals.

Jargon-Free Explanations

I believe insurance should be bought, not sold. I provide transparency and education through plain-English explanations in online meetings, videos, and blog posts.

How It Works

My process is simple: a short, custom intake with a health pre-screen, followed by proposal review, and application. I can join client calls or manage steps independently—always with no sales pressure. I focus solely on LTC insurance, bring deep expertise, with no referral fees for fee-only advisors and compliant options available for others.

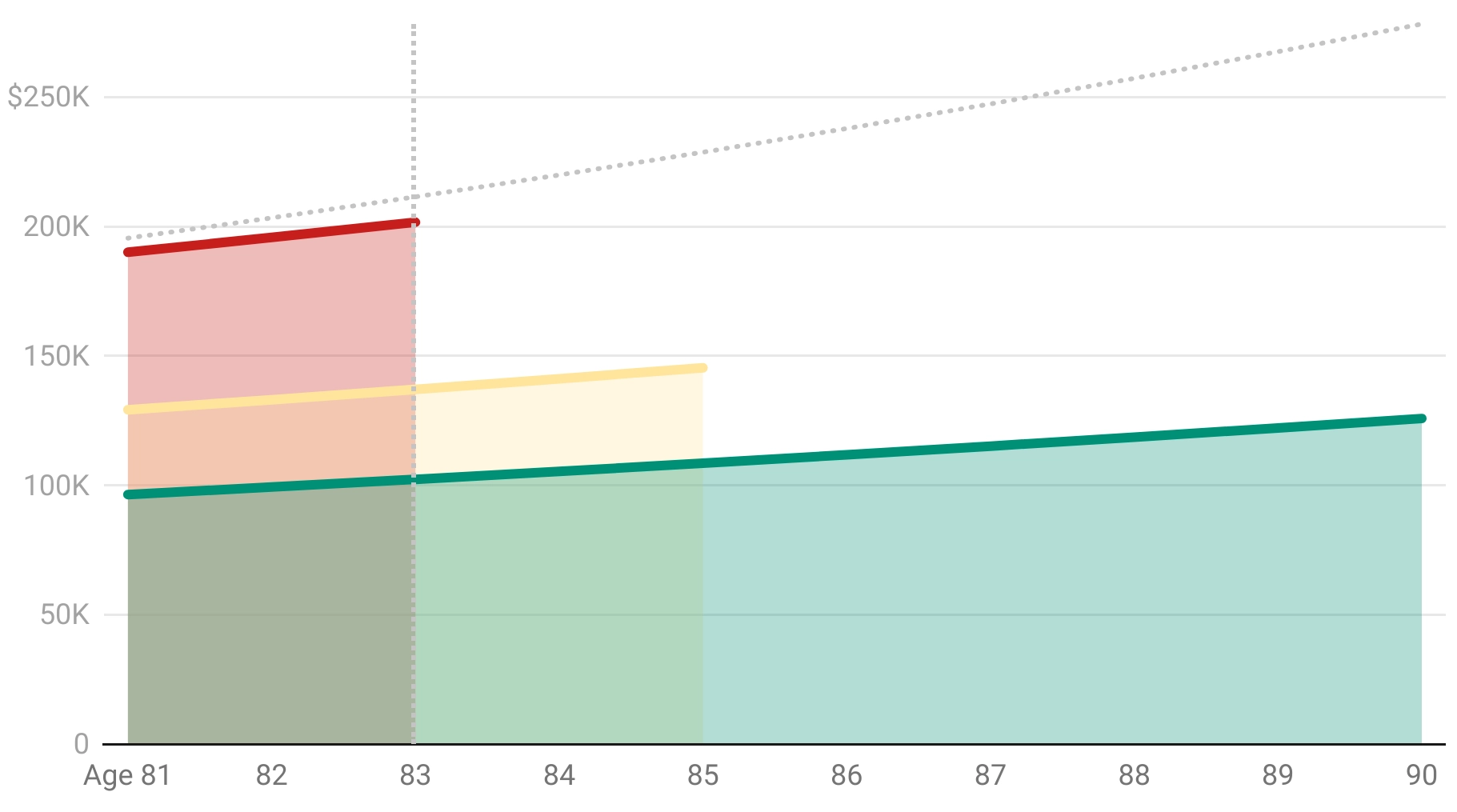

Why Not Self-Fund?

Even families with $3M+ often choose coverage because the risks are so high—just as they still carry health insurance. Home care at 16 hours a day averages $198k per year, rising about 4.5% annually. When care is for cognitive decline, those needs can last more than 8 years. But the decision isn’t just financial—it’s also about lifestyle, options, and peace of mind.

Easier for Family

Remove the decisions and care burden during a stressful time.

Better Options

Clients may prefer 24/7 homecare or a better facility.

Financial Risk

Avoid rushed asset sales. Leave more for loved ones.

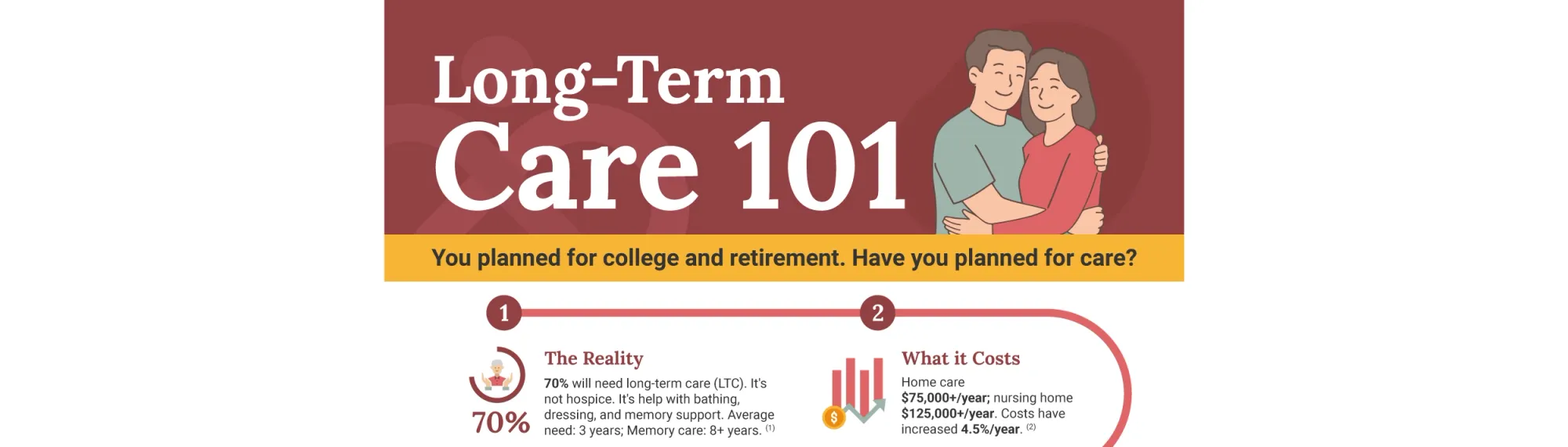

Share This One-Pager With Clients

Download a free, unbranded PDF that briefly explains LTC. No logos, no pitch, just clear facts you can share. It's an easy way to start the LTC conversation without pressure.

About Me

After graduating from Duke University, I began my career on Wall Street managing financial risk. Over three decades, I've founded three mission-driven companies focused on simplifying life’s challenges. I live in Colorado with my wife and two kids. You can learn more about my background on LinkedIn.

Advisor FAQ

What states do you offer insurance in?

I can support clients in all 50 states and the District of Columbia.

How are you compensated?

I'm paid standard commissions by the insurance carrier.

Do you offer commission sharing?

I don’t share commissions with fee-only financial advisors so you can maintain your fee-only status. For fee-based advisors and other professionals, I’m glad to explore compliant partnership options.

What makes a good insurance candidate?

The best time to refer a client is when they're 45-70 and in good health, especially if there is a family history of longevity or Alzheimer’s. Health is a depreciating asset, and planning early provides the widest range of options.

Does referring a client create compliance or liability risk for me?

No. I work directly with clients on the LTC side and handle underwriting and recommendations independently. Referrals do not involve advisors in underwriting decisions or create an ongoing advisory obligation.

Where can I see your content?

Read the website, watch the YouTube channel, or listen on Spotify.

How does LTC insurance work?

Most policies have guaranteed premiums with flexible payment options. Coverage begins immediately, benefits grow with rising care costs, and policies pay for a set number of years across home care, assisted living, memory care, and nursing care. If care is never needed, many refund premiums to heirs. My approach is to provide meaningful coverage—not insure every dollar.

How do you handle privacy?

I collect only what is necessary. Client information stays within the LTC engagement. See our Privacy Policy.

Want to Learn More? Let's Talk

LTC Specialist • Health Pre-Screens • Educational Content

Schedule A Call →