Get practical insights on long-term care (LTC), insurance, and sales strategies designed for financial professionals. Share these LTC takeaways directly with clients. Read past updates.

💡 Sales Idea

Want to offer clients a higher-deductible, lower-cost LTC insurance strategy?

Problem:

Most long-term care insurance policies have a 90-day elimination period—essentially a small deductible. For clients primarily worried about long-tail risks such as Alzheimer’s, that short waiting period often makes the policy more expensive than necessary. Many would rather (partially) self-insure for the first 2+ years of care and pay lower premiums for protection against long-term costs.

Challenge:

Many state laws restrict elimination periods for LTC insurance to no more than 365 days, preventing longer waiting periods.

Solution:

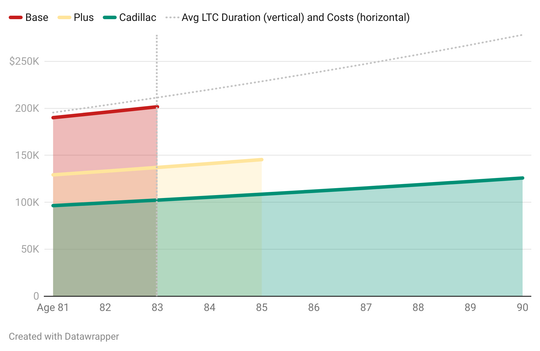

Use a OneAmerica Asset Care design that functions like a high-deductible plan by structuring the benefits this way:

- Lifetime coverage to address long-tail risk

- 0% inflation protection on the first two years of benefits to hold down early-year benefit amounts and premium

- 3% or 5% compound inflation starting year 3 to grow coverage for later-life needs

This approach gives clients both a 90-day elimination period and two additional low-benefit years—creating a higher deductible and lower upfront cost, while shifting more coverage to the later years when care is most expensive.

📺 New Video

This month, I released a new video that explains what long-term care insurance really costs, alongside my blog post on the same topic. These videos make long-term care planning more approachable and easier to understand.

🛍️ New Product

Nationwide has launched a new long-term care solution: CareMatters® Annuity.

Designed for clients who may not qualify for a life/LTC policy like CareMatters II, this annuity still offers 2–3x leverage for long-term care expenses with simplified, more flexible underwriting. Benefits are paid as cash indemnity, giving clients the freedom to use funds however they choose.

❤️ Our Why

Long-term care planning is often ignored, even though about 70% of adults will need care. The lack of planning creates financial strain, caregiver burden, and avoidable uncertainty for families. Our mission is to spark conversations and inspire action through practical, engaging guidance that helps advisors integrate LTC into thoughtful financial planning.