Get practical insights on long-term care (LTC) and insurance for financial professionals. Share these takeaways with clients. Read past updates.

🛍️ Genworth Returns

Genworth, a pioneer in long-term care insurance for more than 30 years, was once the dominant U.S. provider. After years of mispricing their policies, it effectively exited new LTC sales around 2016. Since then, Genworth has focused on its legacy policies, raising premiums, much to the frustration of policyholders.

In recent years, the company has signaled a return to the market by building a national network of vetted care providers, similar to an HMO, under the CareScout name.

With this groundwork in place, Genworth has reentered the market with its first product, CareScout Care Assurance, a traditional LTC policy available in 37 states, with a hybrid version expected soon.

Their new policy takes a cautious approach:

- Using "conservative pricing assumptions,"

- capping eligibility at age 65, and

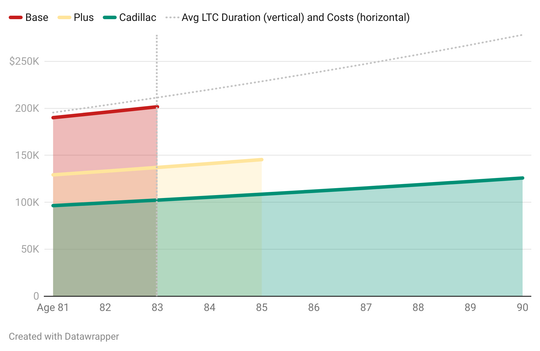

- limiting initial benefits to $250,000 (about three years of assisted living).

🧐 My take: It’s great to see Genworth return to the LTC space. The company has long raised public awareness of the high cost of care, and its care network could help improve provider quality. Still, I would have liked to see more aggressive pricing and benefits, given their deep experience and market data. But as a publicly traded company, shareholders may not allow them this flexibility.

📰 Other News

- November is Long-Term Care Awareness Month. I’m not sure how everyone gets their own month, but more LTC awareness is always a win. 😀

- We also added an AI chatbot to our website that answers questions from our 30+ in-depth blog posts. It's a real time-saver.

📺 In Case You Missed It

Our YouTube channel makes long-term care planning more approachable and easier to understand. In this video, I explain eight key features of long-term care insurance.

❤️ Our Why

Long-term care planning is often ignored, even though about 70% of adults will need care. The lack of planning creates financial strain, caregiver burden, and avoidable uncertainty for families. Our mission is to spark conversations and inspire action through practical, engaging guidance that helps advisors integrate LTC into thoughtful financial planning.