Intro

If you don’t know much about long-term care insurance (LTCi), you’re not alone.

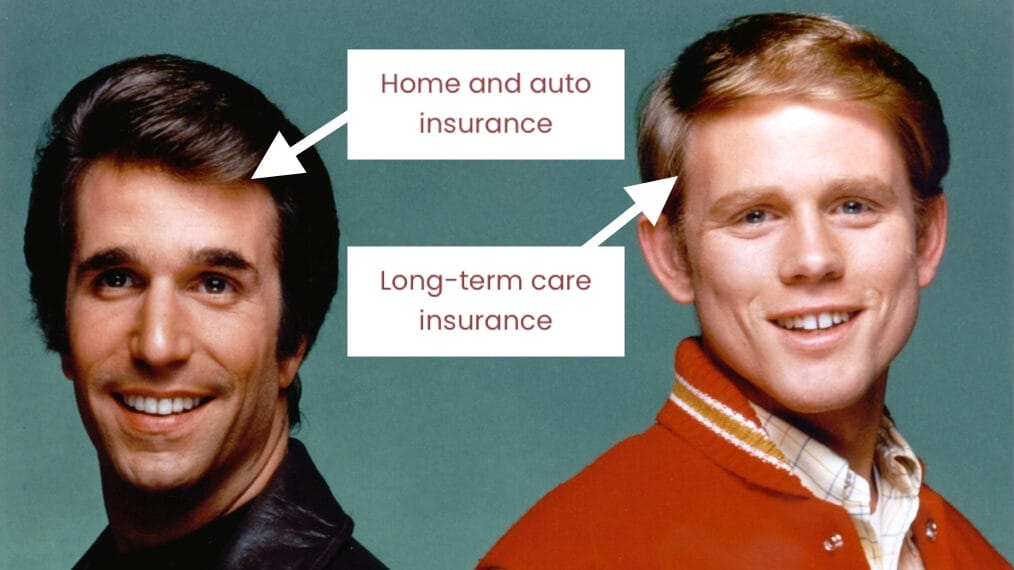

Think about the ads you constantly see for home and auto insurance—they’re everywhere, and they’re hard to miss. If these were Happy Days characters, they’d be Fonzie: bold, unforgettable, and always front and center.

Long-term care insurance, on the other hand, is more like Richie: steady, trustworthy, and invaluable, even if it doesn't always stand out in the crowd.

Many people aren't even sure if they own LTCi. Check out this survey.

And even for those who do, understanding the product isn’t easy—most scored an F+ on a quiz about LTCi knowledge (which begs the question: Is an F+ a thing?).

Insurance can be a valuable tool as you work toward your LTC goals: Learn about options, Talk with family, and Create a plan. In this overview, we’ll break down key posts from this topic, explaining everything in plain English.

We’ve got lots of posts on our Insurance topic. If you'd like a guided tour, just hit the 'next post' button at the bottom of this (and every) post.

Post jargon

benefit: the amount LTCi pays for covered care expenses

hybrid policy: newer LTCi combining life insurance with LTC benefits

LTC: long-term care

LTCi: long-term care insurance

traditional policy: early LTC insurance referred to as "pure" LTCi

➡️ Explore all the LTC jargon

What is it?

LTCi helps cover care costs when you need assistance with basic tasks like bathing or dressing or if you have cognitive issues like Alzheimer’s.

Most policies pay for long-term care in home care, assisted living, nursing homes, memory care, adult daycare, CCRCs, and hospice.

Is LTC really a big problem?

It’s easy to push long-term care (LTC) out of mind until it’s right in front of you. A parent needs help, or you’re the one recovering and realizing you can’t do it all alone. The truth? 50–70% of us will need some kind of care at some point.

So yes, it’s a big deal.

Costs are so high that many insurers have stopped offering policies. States are even stepping in with tax breaks or mandatory programs to help people prepare. This isn’t just about one person—it shapes families, communities, and how we care for each other.

Why get insurance?

For the money

One of the biggest reasons to buy LTCi is that for every dollar you spend you typically get 3x-5x the coverage immediately. 👀

For example, $100k in premiums could turn into $300k to $500k in coverage immediately. That's a biggie.

For your family

LTCi also keeps family members from becoming full-time caregivers.

They love you, of course—but no one wants to ask their kids or spouse to help them out of the tub. With LTCi, family members can focus on coordinating care, not providing it.

Check out this quick 2-minute video about Hank, who had a stroke at 54 and relied on his son for long-term care.

And post-Covid, the cost of care showed a curve that would make Tony Hawk jealous.

For more reasons to get LTCi, check out this post:

Policy types

There are two main types of LTCi: traditional and hybrid. Both help cover long-term care costs but differ in structure and benefits, making it key to review the pros and cons of each.

- Traditional: Started in the 1960s, these went through some growing pains but have improved over time. They’re considered "pure" LTC insurance.

- Hybrid: These came on the scene in the 1990s and improved upon traditional policies. They’re a combination of life insurance and long-term care insurance.

Benefits

One of the most important things to understand about LTCi is how benefits are paid—it’ll help you choose the right policy.

Every policy has a few parts:

- Your benefit pool (e.g., $300k available to cover your care)

- How your money grows (e.g., 3% interest compounded annually)

- When benefits start (e.g., after 90 days of qualifying for LTC)

- How benefits are paid (e.g., spread over 4 years)

Unlike health insurance, LTCi benefits:

- Can be accessed at any point in your lifetime, not just within the next year.

- Cover a limited period of time (e.g., 6 years) or dollar amount with a few exceptions.

Policies also vary in how they handle payouts. Some reimburse your actual care costs, while others give you a lump sum, regardless of your costs.

In other posts, we'll explain how this all works in plain English.

How much does LTCi cost?

You can buy as much or as little insurance as you'd like, but the amount of benefits you receive varies on a number of factors.

- Personal details: Age, health, and gender all impact cost—women generally pay more because they live longer and need more care.

- Policies aren’t created equal: Even with the same benefits, prices can differ. Shop around.

- Flexible options: You can adjust your coverage to fit your budget.

- Save on taxes: Special tax breaks can lower your after-tax cost, especially if you're a business owner.

Payment options

LTCi policies offer many payment options.

- You can make one lump sum for the lowest overall cost.

- Or spread payments out over 5 years, 10 years, or even until age 100 for lower annual costs but a higher total cost.

Purchase considerations

When buying LTCi, consider the timing, how much coverage you need, and whether to self-fund part of your care. We're here to help with those decisions.

Qualifying

Underwriting is when you apply for LTCi, and the insurer reviews your health to decide coverage and cost. Since about a third of applicants are denied, applying early while you're healthy improves your chances.

Wrap up

Whether you’re trying to figure out which policy is right for you or just want to understand how benefits work, we’re here for you.